Finding Money

A life insurance settlement may hold the hidden source

of cash to fund your next fixed indexed annuity sale.

Every agent on the planet who is actively selling annuities has heard the objection from a prospect:

“I love your concept, but all my money is tied up.”

Of course, your comeback is to motivate Mr. & Mrs. Prospect to move at least some of their funds into the safety of a FIA. But if and when you find yourself out of bullets, please do not part company without taking a final shot with something like:

“One last thought before I go. We sometimes find that retirees may have an old life insurance policy they’re still paying on, or that may even be paid up. Oftentimes the reason for taking it out so long ago has changed because life circumstances change over the years. I have a way to ‘repurpose’ this kind of dormant asset for usually more than its cash value, and apply the money toward your retirement needs today…”

Eureka! Suddenly your dying sales interview springs back to life with the prospect of using the settlement on a life insurance policy as found money.

Actually, before life insurance settlements (also known as viatical life settlements), there were two options when a senior had a life insurance policy that was no longer needed. He or she could either let the life insurance policy lapse or cash it in for its surrender value.

Now seniors have an excellent opportunity to capitalize on their current life insurance policy using a life settlement solution. Such life insurance settlements allow seniors to cash in their insurance, but in a new way. Instead of cashing in their policy with the issuing life insurance company, they can work with a bonded life settlement broker to cash in their policy with a financial institution that will pay more. The Life Insurance Settlement Association can provide additional information on the industry.

|

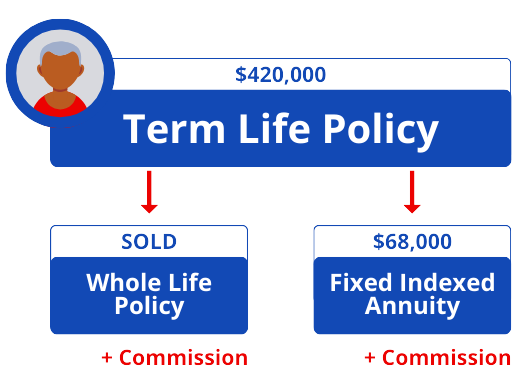

Simply put, the transaction is a buy-and-sell exchange between a policy owner and an investor, facilitated by a bonded life settlement company or broker. The policy owner deals directly with the broker who negotiates on his or her behalf. There is no fee to the seller. The broker’s job is to package and present the deal for competitive bidding. Financial institutions bid for the best portfolio investments. Once limited to the terminally ill, senior life insurance settlements have evolved into a unique opportunity for today’s mature market. And it works for individuals, businesses and charities. Dollar amounts are based on the death benefit, not the cash value. Ideal life settlements are a percentage of the net face value (death benefit minus outstanding loans and accrued interest) and are always greater than any cash surrender value. For example, one recent case involved a 74 year old male with a $420,000 term life policy, no cash value. The life insurance settlement broker converted the policy to whole life. The purchasing investor took over premium payments. The happy client tucked a tidy $68,000 into his fixed index annuity. And the agent socked away a decent commission on the life insurance settlement (3% of the policy death benefit) plus a second commission on the FIA. Not a bad day's pay. |

|

Reasons for using a life insurance settlement to fund an annuity:

• Beneficiary is deceased and coverage is no longer needed, or beneficiary is financially well off and no longer in need of death benefit for survival

• Premiums are no longer affordable

• Estate size has changed and policy coverage amount is too large for estimated estate taxes

• People are living longer. Retirement income needed over longer period

• Better quality of life with greater cash flow

In its simplest form, your clients can receive more money in the secondary market than from their life insurance company. They avoid paying surrender charges from the insurance company and no longer need to make premium payments.

The Bottom line

All of this may sound simple, but resources, time, and experience are essential. A bonded life insurance settlement company should have all the tools to make sure that your client’s settlement is completed properly and efficiently.

While InsuranStar Marketing neither endorses nor recommends any life settlement solution or senior life insurance settlement broker, as an annuity producer and Wholesale Distributor I’ve worked with one bonded life settlement broker whom I can recommend with confidence. Trust is everything in this game. Call me for details.

NOTE: Check out all the free stuff on this website including free annuity insurance leads.

Privacy Policy: We never sell, rent or trade your email address.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.